Montana Legislature

Grass Roots Efforts

69th Montana Legislature

January 6 – April 30, 2025

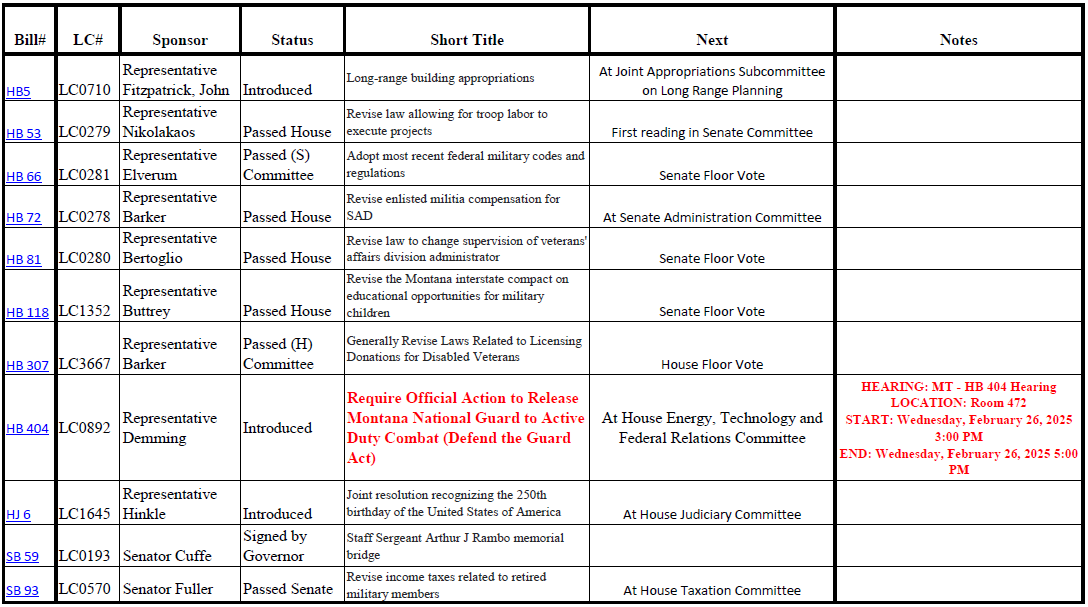

An act creating the “DEFEND THE GUARD ACT”, Requiring an official Congressional declaration or action to release the Montana National Guard to active combat duty; Providing powers of the Governor regarding the Montana National Guard, Providing definitions; and Providing an immediate effective date.

To be heard in the House Energy, Technology, and Federal Relations (ETFR)

HEARING: MT – HB 404 Hearing

LOCATION: Room 472

START: Wednesday, February 26, 2025, 3:00 PM

END: Wednesday, February 26, 2025, 5:00 PM

PARTICIPATE Virtually!

- Send messages through the website

- Phone Messages

- Attend Committee Hearings

- Watch/Listen – meetings live streamed

- Testify remotely via Zoom

Who Is My Legislator?

Not sure who represents you in the Montana Legislature? Need to know how to contact your legislator? Visit this webpage to find your legislator.

Legislative Issues of Interest to Montana Military and Veterans

These bills are brought forward by State Senators and Representatives and are of interest to military organizations including the Enlisted Association, Officer’s Association, American Legion, and the Department of Military Affairs.

EANGMT Resolutions

Resolution #22-01: EANGMT Legislative Priorities

Resolution #22-02: Exemption of Title 32 Earnings

Resolution #22-03: Exemption of Income from Military Pensions or Retirement

Resolution #22-04: Establish a Military Strategic & Economic Impact Task Force

An act revising enlisted militia compensation for state active duty; Removing the 15-day limitation on compensation; Providing an immediate effective date.

An act changing supervision of the Veterans’ Affairs Division Administrator; Moving supervision from the Board of Veterans’ Affairs to the Adjutant General.

An act establishing the Staff Sergeant Arthur J Rambo Memorial Bridge; and directing the Department of Transportation to install signs.

An act establishing the Staff Sergeant Arthur J Rambo Memorial Bridge; and directing the Department of Transportation to install signs.